Retiring early doesn’t have to mean a life of luxury—it can be achieved through intentional, budget-conscious efforts known as Lean FIRE strategies. This approach focuses on extreme frugality and simple living to reduce expenses, optimize savings, and achieve financial independence goals faster.

Adherents of this philosophy prioritize lifestyle downsizing, debt reduction, and sustainable budgeting to free up cash flow for long-term financial security.

Embracing practices like DIY home projects, secondhand shopping, and cutting non-essential expenses allows Lean FIRE enthusiasts to build wealth while enjoying time freedom.

This strategy offers a pathway to early financial security without the need for extravagant resources or high incomes.

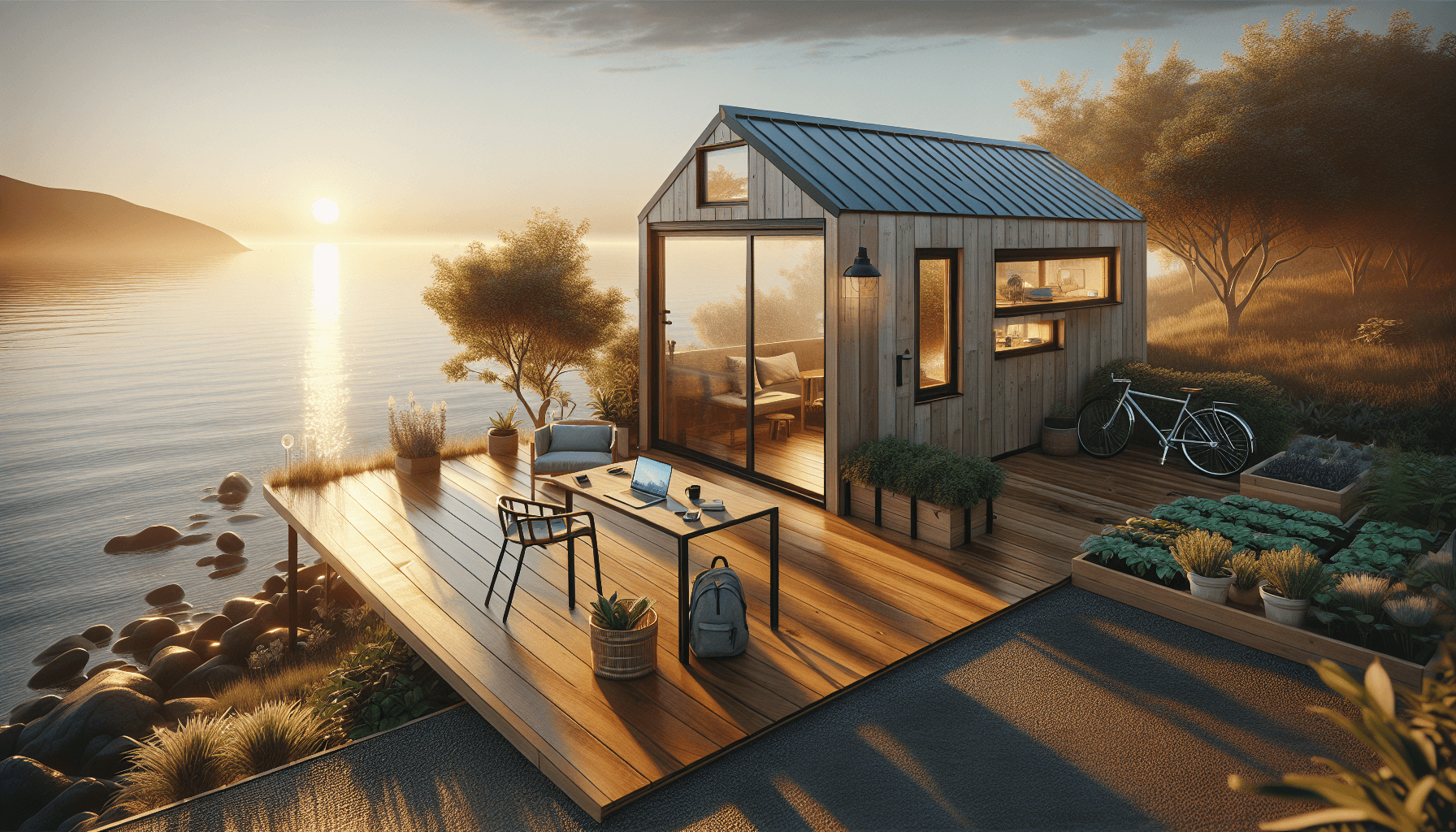

Minimalist Living For Lean FIRE

Minimalist living plays a pivotal role in the success of the Lean FIRE philosophy, helping individuals align their lifestyles with low-cost approaches to early retirement planning.

By focusing on intentional spending and reducing unnecessary commitments, this method emphasizes practicality and sustainability. Below are ways to integrate minimalist living into your plan for achieving Lean FIRE:.

Streamline Living Arrangements

- Lifestyle downsizing: Moving into smaller homes or apartments to lower housing expenses is a foundational tactic. Relocating to low-cost-of-living areas provides even greater savings opportunities.

- Geographic cost arbitrage: Some opt for international or domestic moves to areas with significantly reduced costs of living, enabling their savings to go further.

- Energy efficiency: Adopting environmentally conscious living methods, such as using energy-efficient appliances, further reduces overhead.

Optimize Day-to-Day Spending

- Secondhand shopping habits: Purchasing pre-owned items for clothing, furniture, and household goods helps cut costs without sacrificing quality.

- DIY home projects: Activities like repairing appliances, mending clothes, or growing a small vegetable garden foster economic self-reliance and long-term savings growth.

- Reducing expenses: Utilizing public transportation, driving used cars, and cooking meals at home instead of dining out are core cost-cutting approaches for a frugal mindset.

Focus on Financial Goals

- Aggressive savings plans: Lean FIRE typically requires saving up to 50–70% of your income. This effort is supported through tools like retirement planning calculators to track progress.

- Investing wisely: Passive income strategies, such as focusing on low-cost index funds and ETFs, allow for sustainable growth and steady returns. Diversifying your portfolio is equally important for minimizing risk.

- Debt snowball strategies: Eliminating high-interest debt first is essential to achieving early financial security and expense management.

By implementing these minimalism-driven choices, individuals not only optimize their budgets for early retirement but also adopt a more intentional, focused approach to achieving financial independence goals. These efforts contribute to personal finance mastery and a life centered on time freedom rather than material accumulation.

Financial Independence Goals Explained

Minimalist living drives financial independence goals by emphasizing budget efficiency and a well-defined roadmap for early retirement. These goals often focus on reducing expenses and achieving time freedom, enabling individuals to prioritize personal aspirations.

A key principle involves calculating a FIRE number, typically 25 times annual expenses, or applying the 3% withdrawal rule to establish sustainable retirement savings goals.

With intentional spending and financial literacy skills, individuals can optimize cash flow while aligning with their long-term plans.

Strategic Financial Planning and Minimalism

Embracing a minimalist financial planning approach fosters a low-cost lifestyle that supports financial freedom.

Through sustainable budgeting and expense management, individuals can curtail unnecessary overhead and adopt high savings priorities. Simplifying life by downsizing homes, limiting material possessions, and focusing on simple financial systems promotes long-term savings growth.

This streamlined approach aids goals like early financial security and wealth building.

Passive Income and Compound Growth

Passive income strategies are essential for achieving aggressive savings plans. Low-cost investments, including index fund strategies and ETF investments, offer opportunities to maximize returns through compound interest growth.

Portfolio diversification techniques and strategic asset allocation ensure that savings remain on a reliable path to financial independence.

For those practicing Lean FIRE, the combination of intentional spending and low-cost investments amplifies progress toward workforce exit strategies.

Extreme Frugality for Early Retirement

Extreme frugality incorporates deliberate cost-cutting approaches to accelerate financial freedom journeys.

This philosophy emphasizes environmental consciousness and lifestyle downsizing to reduce expenses significantly while maintaining quality of life. By focusing on minimalist-driven choices, individuals align their financial goals with sustainable practices and simple living.

Cost-Cutting Approaches in Everyday Life

Efficient expense management begins with reducing discretionary spending and adopting alternative revenue streams.

Activities such as secondhand shopping habits, DIY home projects, and cooking meals at home provide ample opportunities for savings optimization. Used cars and public transportation further enhance budget-conscious living, while energy-efficient habits contribute to affordable living options.

Investing for Early Retirement

Alongside frugal living, aggressive investment strategies play a pivotal role.

Low-cost index funds and ETFs allow individuals to maximize investment returns while adhering to Lean FIRE principles.

Geographic cost arbitrage and debt reduction practices enable sustained financial independence goals, supporting retirement preparation and a minimalist lifestyle.

By balancing economic self-reliance with smart investing, early retirement planning becomes an achievable reality within the FIRE philosophy.

Financial Independence

- Minimalist living emphasizes budget efficiency and intentional spending to optimize cash flow.

- Calculating a FIRE number, typically 25 times annual expenses, helps establish sustainable retirement goals.

- Passive income strategies, like index funds and ETFs, leverage compound interest for long-term savings growth.

- Extreme frugality incorporates cost-cutting approaches such as secondhand shopping and energy-efficient habits to reduce expenses.

Passive Income Strategies To Retire

Achieving financial independence goals starts with establishing income sources that require minimal ongoing effort. Passive income strategies, such as rental income, dividend-paying index funds, and digital product sales, offer an effective way to create cash flow optimization while reducing reliance on active work.

Lean FIRE adherents often achieve early financial security by investing in Real Estate Investment Trusts (REITs) or peer-to-peer lending platforms, which provide consistent returns.

Maximizing investment returns is also possible through the creation and sale of digital assets like courses or eBooks, which offer scalable revenue potential.

Real Estate and Alternative Investments

Investing in real estate—whether through physical properties or REITs—provides an opportunity for portfolio diversification techniques.

Utilizing geographic cost arbitrage by targeting low-cost-of-living areas can further enhance returns. Peer-to-peer lending offers another supplemental source of alternative revenue streams, catering to those with a frugal mindset and financial literacy skills aiming to diversify.

Dividend Investments and Tax Efficiency

Dividend-paying stocks, index funds, and ETFs are popular passive income strategies for those pursuing early retirement planning.

Reinvesting dividends allows for compound interest growth, significantly boosting long-term savings growth. Efficient tax strategies, such as taking advantage of Roth IRAs, ensure that passive income streams are optimized for future wealth building while reducing tax burdens.

Digital Income and Simple Financial Systems

Creating digital products or developing automated online businesses supports minimalism-driven choices and simple financial systems.

These efforts align with personal finance mastery goals, as they enable scalable income over time with minimal overhead.

Combined with intentional spending and sustainable budgeting, they serve as powerful tools for achieving early retirement and financial freedom.

Savings Optimization And Budgeting Tips

Establishing a strong foundation with savings optimization is essential for meeting retirement savings goals.

A budget-conscious living approach ensures that every expense is intentional and aligned with early retirement aspirations. Exploring cost-cutting approaches such as downsizing housing or adopting a low-cost lifestyle can dramatically increase available funds for investing and wealth building.

Housing and Transportation Expense Management

- Reduce overhead by transitioning to affordable living options like smaller homes or low-cost-of-living areas.

- Adopt environmentally conscious living habits, such as using public transportation or purchasing fuel-efficient, used cars.

- Engage in lifestyle downsizing to align with minimalist living and financial independence goals.

Debt Reduction and Intentional Spending

Aggressive savings plans often require eliminating debt to maximize cash flow. Utilizing debt snowball strategies or similar methods helps reduce financial stress and redirect funds toward asset allocation strategies. Practicing intentional spending through secondhand shopping habits or DIY home projects enhances economic self-reliance while supporting early retirement planning calculators.

Tools and Long-Term Growth

- Use apps like You Need A Budget (YNAB) to track spending effectively and develop financial literacy skills.

- Invest consistently in ETFs or index fund strategies for sustainable long-term savings growth.

- Prioritize maximizing investment returns while maintaining disciplined expense management for a sustainable financial freedom journey.

Passive Income

- Investing in dividend-paying index funds enables compound interest growth through reinvested dividends.

- Real Estate Investment Trusts (REITs) provide consistent returns and portfolio diversification.

- Creating digital assets like eBooks or courses offers scalable revenue with minimal overhead.

- Efficient tax strategies, such as using Roth IRAs, reduce tax burdens and optimize wealth building.

Managing Expenses For Financial Freedom

Minimalist living begins with intentional expense management, forming a foundation for financial independence goals. By embracing a frugal mindset and reducing expenses, individuals unlock savings optimization opportunities to advance their financial freedom journey.

Tools like budget apps (e. g. , Mint, YNAB) or detailed spreadsheets enable better expense tracking, helping identify inefficiencies and redirect funds to achieve long-term goals.

Early retirement planning often incorporates lifestyle downsizing, such as transitioning to smaller homes or adopting secondhand shopping habits.

These methods align with simple living principles while reducing overhead costs.

Optimizing Lifestyle Choices

Adopting extreme frugality is essential for sustainable budgeting. Shifting to a low-cost lifestyle by living in affordable areas, using public transportation, purchasing used cars, and practicing DIY home projects can significantly reduce financial strain.

Engaging in intentional spending habits—like cooking at home or growing your own food—provides long-term cost-cutting benefits while supporting environmentally conscious living. This enables more resources for wealth building and cash flow optimization.

“Reducing expenses through strategic lifestyle downsizing opens the path to time freedom and accelerates progress toward financial independence. ”

Strategies for Expense Reduction

- Eliminate debt with debt snowball strategies or aggressive savings plans to minimize interest payments.

- Implement simple financial systems to track and adjust spending effectively.

- Avoid wasteful habits by embracing secondhand shopping or investing in energy-efficient home solutions.

- Build financial literacy skills to identify opportunities for overhead reduction and budget-conscious living.

With consistent financial discipline and sustainable budgeting, individuals pursuing the FIRE philosophy can achieve expense management mastery. These intentional spending techniques support the ultimate goal of early financial security and retirement preparation.

Investment Strategies For Long-Term Growth

Wealth building for financial independence relies on deliberate and strategic financial planning. Early retirement planning enthusiasts frequently implement passive income strategies such as index fund strategies or ETF investments to maximize investment returns while adhering to minimalist financial planning principles. Starting investments early enables compound interest growth, a concept that exponentially enhances long-term savings growth over time. This approach ensures better alignment with retirement savings goals.

Portfolio Diversification Techniques

Diversifying investments through asset allocation strategies can mitigate risks. A well-balanced portfolio typically includes:.

- Low-cost index funds for lower fees and ease of management.

- ETFs that provide diverse exposure across industries.

- Bonds for stability during economic downturns.

“Strategic financial planning involves aligning investments with your financial independence goals, fostering economic self-reliance. ”

Tools and Methods for FIRE Planning

Using retirement planning calculators aids in determining a realistic FIRE number, guiding your savings optimization journey. Many individuals choose to calculate their FIRE number as 25 times their annual expenses or employ the more conservative 3% withdrawal rule for financial security. Extreme frugality combined with high savings priorities ensures steady progress toward workforce exit strategies.

By practicing financial discipline, leveraging minimalism-driven choices, and adopting aggressive savings plans, individuals position themselves for sustained long-term savings growth. The pursuit of financial freedom goals through maximizing investment returns offers a reliable pathway to achieve early financial security.

Financial Freedom

- Budget apps like Mint and YNAB help track expenses and identify inefficiencies.

- Extreme frugality, such as downsizing homes or secondhand shopping, reduces overhead costs.

- Investing in low-cost index funds and ETFs maximizes long-term savings growth.

- Calculating a FIRE number (25x annual expenses) aids in retirement planning.

Time Freedom Through Lifestyle Downsizing

Minimalist living offers a pathway to achieving time freedom by embracing simplicity and reducing financial obligations. Lifestyle downsizing encourages adopting smaller living spaces, relocating to low-cost-of-living areas, and embracing frugal habits to significantly lower expenses.

By prioritizing a frugal mindset and reducing unnecessary possessions, individuals can redirect more resources toward financial independence goals.

Steps like using public transportation, purchasing used cars, and engaging in DIY home projects help optimize savings without compromising quality of life.

These adjustments not only support early retirement planning but also foster a more intentional and meaningful lifestyle.

Key Strategies for A Low-Cost Lifestyle

Adopting a low-cost lifestyle revolves around deliberate choices that enhance financial flexibility. Downsizing living arrangements—such as moving to smaller homes or exploring affordable living options—can drastically reduce housing expenses.

Incorporating cost-cutting approaches, like meal prepping and adopting energy-efficient habits, minimizes ongoing costs. For those seeking early financial security, eliminating debt through methods like debt snowball strategies is critical for creating sustainable financial freedom.

Engaging in DIY home projects, growing your own food, and shopping secondhand are practical ways to adopt minimalism-driven choices while preserving resources for future goals.

Financial Benefits of Lifestyle Downsizing

By embracing strategic financial planning aligned with the principles of simple living, individuals can achieve significant financial milestones.

Downsizing supports debt reduction and promotes an increase in cash flow optimization.

Investing savings into low-cost vehicles like index funds or ETFs accelerates long-term savings growth while leveraging compound interest growth. Calculating retirement savings using tools like retirement planning calculators facilitates goal tracking.

These measures enable the pursuit of early retirement and a lifestyle aligned with the FIRE philosophy, ultimately leading to enhanced time freedom and peace of mind.

Lifestyle Downsizing

- Minimalist living reduces financial obligations and enhances time freedom.

- Downsizing to smaller homes or low-cost areas significantly lowers expenses.

- Engaging in DIY projects and adopting frugal habits optimize savings.

- Investing in index funds or ETFs accelerates long-term financial growth.